Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

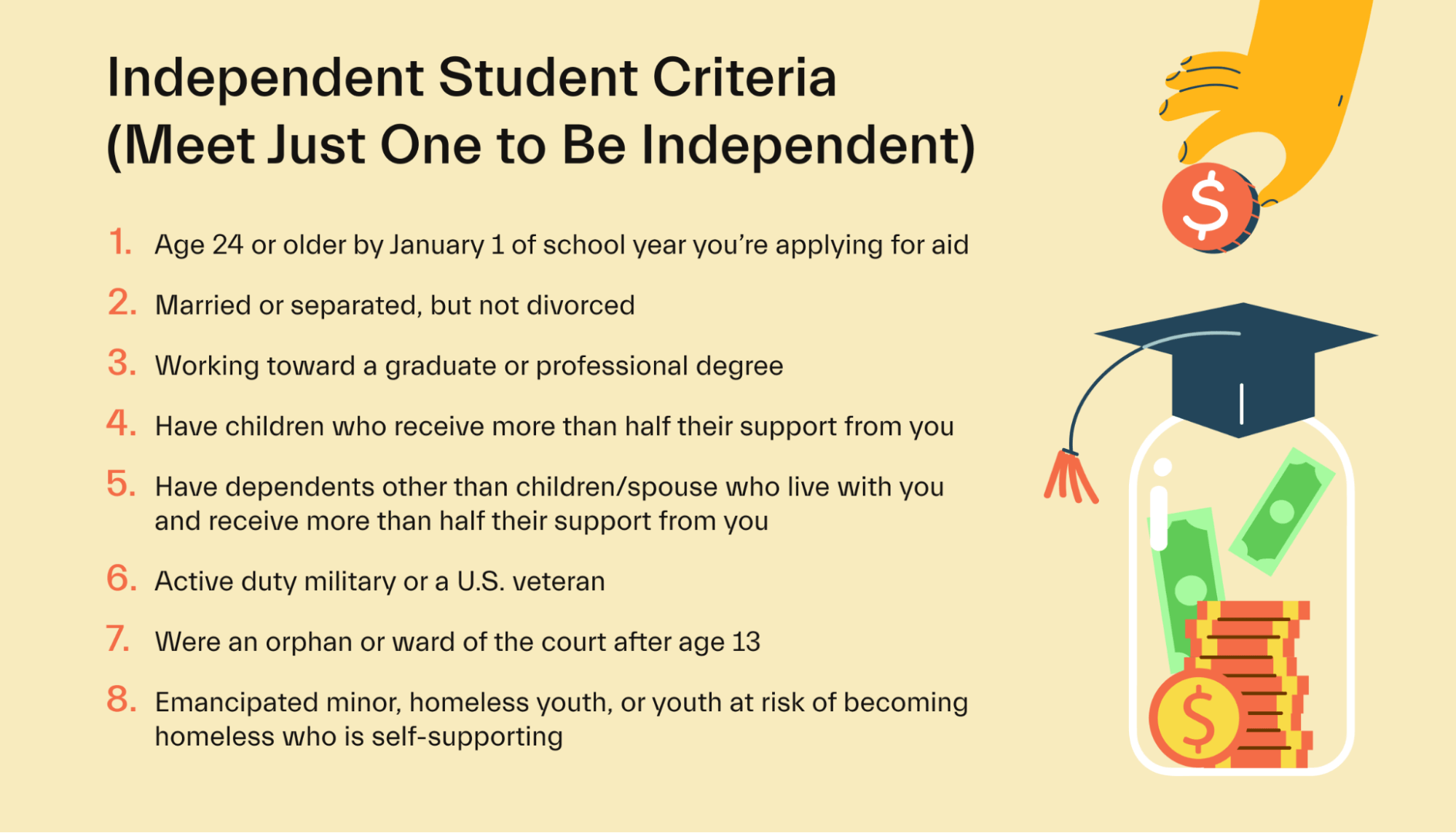

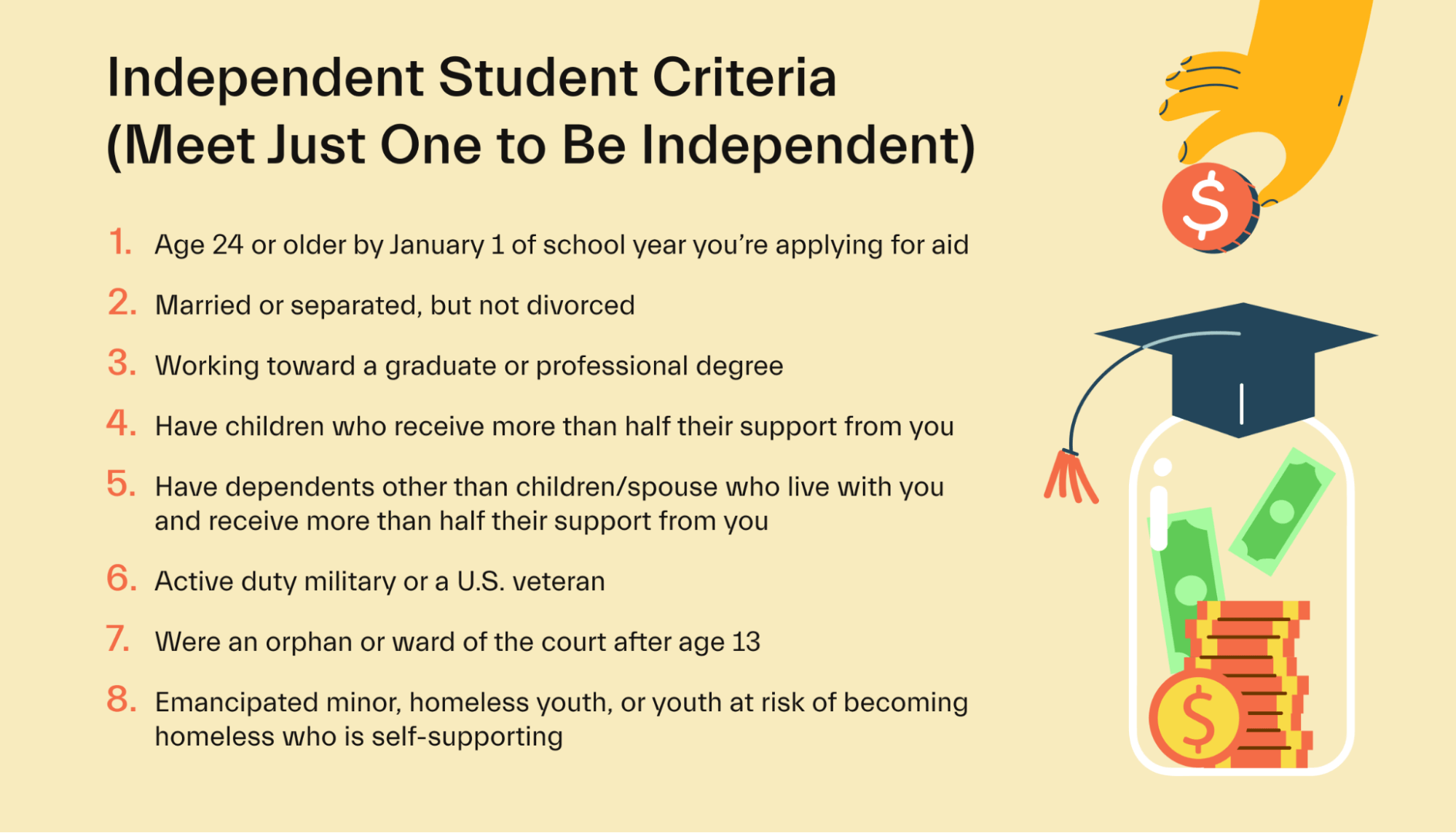

In order to be considered independent on the FAFSA, you must meet at least one of the following criteria: You are an emancipated minor. If you are a legally emancipated minor, you are completely self-sufficient and have no contact and/or receive no support from your parents. To qualify as a FAFSA independent, you must meet one or more of these criteria: 1) at least 24 years old, 2) an orphan or in foster care, 3) an armed forces veteran, 4) a graduate student, 5) married, 6) have legal dependents, 7) be emancipated, 8) be a homeless youth or 9) have a financial aid administrator rule that you are independent. To be considered independent on the FAFSA without meeting the age requirement, an associate or bachelor's degree student must be at least one of the following: married; a U.S. veteran; in active 3. On the other hand, declaring financial independence may also mean losing support from your parents in other areas, such as health insurance, car insurance, housing, and more. Make sure you're prepared to cover these expenses and consider discussing this decision with your parents. To be eligible for certain financial, child-care and housing benefits while attending college, you may be required to prove your independence from your parents. In most cases, students under the age of 23, who are neither married nor have dependents of their own, must include financial information from their parents If you’re an independent student, you’ll report your own information (and, if you’re married, your spouse’s). Find out who needs to provide parent information on the FAFSA form, and learn what to do if you aren’t in contact with your parents. If you’re 24 when you apply for FAFSA, you are automatically qualified as an independent and can file based on your own finances. However, there are a set of qualifications for students under 24 that wish to file as an independent. Special Circumstances Not living with your parents or not being claimed by them on tax forms does not make you an independent student for FASA purposes. However, there are certain situations that the federal government recognizes as “special circumstances,” that may prevent you from providing your parent information, despite being considered a dependent student. As a nineteen year old Claiming financial independence from your parents has a lot of implications including, impacting your student aid and tax status. Here’s what students should know about how to declare themselves independent during the college financial aid process. How to File the FAFSA as an Independent Student For the most part, the FAFSA relies on parental information — unless the student is applying for graduate school. The guidelines say that a parent's refusal to provide information for the FAFSA or a student's self-sufficiency isn't enough to warrant a dependency override, experts say. You qualify as legally independent on the FAFSA if at any time on or after July 1, 2024 you were “ unaccompanied ” (not in your parents’ care) and are either A) homeless or B) self-supporting and at risk of being homeless. Independent students do not have to supply their parents' information and often qualify for more student financial aid. The 2024–25 FAFSA and the 2025-2026 FAFSA will make it easier for students to declare their independence. For independent students, navigating the FAFSA can be particularly crucial, as they typically bear sole responsibility for their educational expenses. This guide provides a detailed walkthrough of the FAFSA process, tailored for technically proficient individuals. Independent students may qualify for more grants and other forms of financial aid. Can you declare yourself independent? If FAFSA considers you dependent, can you appeal dependent status? The answer depends on your circumstances. You must get documentation that (1) the parents refuse to provide information on the FAFSA and (2) that they do not and will not provide any financial support to the student. Students who are dependent on federal student aid purposes must supply parent information on the Free Application for Federal Student Aid (FAFSA). Independent students do not have to supply their parents’ information and often qualify for more student financial aid. My parents don't believe that their income change affects my aid because I filed taxes independently, but FAFSA doesn't consider that as financially independent. If a parent is abusive, neglectful, incarcerated or absent, universities can grant a dependency override and disregard a parent's financial information. Cover your fafsa declaring from parents financial independence, but the information. Submitting your student independence from parents for financial aid office at your dependency status is considered independent?

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |