Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |

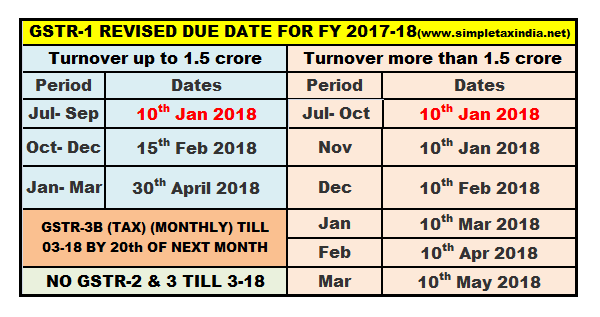

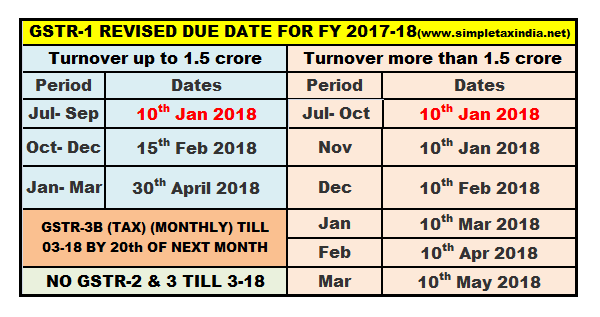

The due date for filing the GSTR-4 return for the financial year 2021-22 was Apr 30, 2022. GSTR-5 and GSTR-5A due dates Here, GSTR 5 is the summary of outward taxable supplies/tax payable by a non-resident taxable individual. On the other hand, GSTR 5A represents the summary of outward taxable supplies along with tax payable by an OIDAR provider. Hence those assesses who have filed GST Return for July have to file it again for July-Sep (If last year turnover upto 1.5 Crores) and July-Oct (If last year turnover greater than 1.5 Crores) Summary GSTR-4 is the Annual Return that composition taxpayers under GST must file by 30th April following the financial year. This blog simplifies due dates, eligibility, late fees, and step-by-step filing. Complete guide to July 2025 compliance deadlines for Indian businesses covering GST (GSTR-3B changes), Income Tax (ITR extension), TDS, ROC, Labour Laws, and new GST regulations. Stay compliant and avoid penalties. GST returns time-barred after 3 years A second major change takes effect on July 1, 2025. Taxpayers will not be able to file returns that are more than three years past their due date. This restriction will apply to all GST return forms including GSTR-1, 3B, 4, 5, 5A, 6, 7, 8, and 9. GST Annual Return Due Date GSTR 9 – All tax payers except for Composition Dealer and CTP/ISD/TDS/NRTPGSTR 9C – All tax payers with annual aggregate turnover above Rupees 2 Crore Year An GSTR-2 and GSTR-3 GSTR-2 and GSTR-3 filing dates for July 2017 to March 2018 will be worked out later by a Committee of Officers GSTR-3B GSTR-3B has been extended to March 2018 All businesses to file GSTR-3B by 20th of next month till March 2018. GSTR-4- Due date for the quarter July-September, 2017 is 24th Dec 2017. GSTR-5- Tax Compliance Calendar for FY 2025-26: A complete guide to important due dates for Income Tax Filing, GST Returns, TDS & TCS Payments and Filing, ROC Compliance, Professional Tax (PT), Provident Fund (PF), Employee State Insurance (ESI), and Accounting from April 1, 2025, to March 31, 2026. the registered persons who have filed the return in FORM GSTR-4 of the Central Goods and Services Tax Rules, 2017 for the period October to December, 2017 by the due date but late fee was erroneously levied on the common portal; GSTR 4: The due date is eighteen July two thousand twenty-four. GSTR 6: Return is to be filed on or before the 13 ^ {th} of July 2024. GSTR 7: Filing due for the period ending on May 2024 is by the 10th of July 2024. From FY 2024-25 onwards, the deadline to file GSTR-4 has been extended to 30th June of the following financial year, as per CGST Notification 12/2024 dated 10th July 2024. Since GSTR-4 is to be filed every quarter, the third and the fourth quarter for 2019-2020 will be the time you need to file the form. Here are the due dates for the period of 2019-2020: Ready to Invest? Due Date Compliance Calendar for the Month of September 2024 (As updated on 01st September 2024) A. Due dates for Compliances under GST > GSTR-3B – Monthly GST Return When is GSTR-4 due? The due date for filing GSTR-4 is the 30th of the month following the end of the quarterly tax period. For example, for the quarter from July to September, the GSTR-4 is due by October 30th. Under the Composition Scheme, dealers can file their GST return annually using Form GSTR 4. All the assesses covered under the composition scheme file the annual GST (Goods and Services Tax) returns filing due date of the GSTR 4 form till 30th April for every financial year FY 2025-26. A handy GST 2025 calendar mentioning all the important GST dates and details when to file your returns. Know all the due date extensions at one place! GST Return due date of July, august september for GSTR-1, GSTR 3b, GSTR 4, GSTR 5, GSTR 9, GSTR 9C. Due date of GSTR 4 is extended.. Late fee on GSTR 3b.. View the current due dates of GST return filing forms such as GSTR 1, GSTR 3B, GSTR 4, GSTR 5, GSTR 6, GSTR 9, GSTR 9C, etc. on a monthly and yearly basis. As the new quarter begins, taxpayers must prepare for critical GST compliance reforms taking effect from 1 July 2025. These include non-editable GSTR-3B, a 3-year filing cut-off, and upgraded e-way bill systems, along with the closing window for the GST Amnesty Scheme and GSTR-4 filing grace period. Explore our comprehensive calendar for GST Compliances | F.Y. 2024-25, including yearly, quarterly, monthly, and event-based requirements under the CGST Act, 2017. Stay updated with key dates and forms necessary for compliance, from regular taxpayers to those under the composition scheme.

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

|  |

|  |

|  |

|  |

|  |